corrNominal

corrNominal measures strength of association between two unordered (nominal) categorical variables.

Description

corrNominal computes , \Phi, Cramer's V, Goodman-Kruskal's \lambda_{y|x}, Goodman-Kruskal's \tau_{y|x}, and Theil's H_{y|x} (uncertainty coefficient).

All these indexes measure the association among two unordered qualitative variables.

If the input table is 2-by-2 indexes theta (cross product ratio), Q=(theta-1)/(theta+1) and U=Q=(sqrt(theta)-1)/(sqrt(theta)+1) are also computed Additional details about these indexes can be found in the "More About" section or in the "Output section" of this document.

Example of option conflev.out

=corrNominal(N,

Name, Value)

Examples

corrNominal with all the default options.

corrNominal with all the default options.

corrNominal with all the default options.

corrNominal with all the default options.Rows of N indicate type of Bachelor degree: 'Economics' 'Law' 'Literature' Columns of N indicate employment type: 'Private_firm' 'Public_firm' 'Freelance' 'Unemployed'

N=[150 80 20 50

80 250 30 140

30 50 0 120];

out=corrNominal(N);

Chi2 index

221.2405

pvalue Chi2 index

5.6588e-45

Phi index

0.4704

Cramer's V

0.3326

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ ________ ______ __________

CramerV 0.3326 0.024431 13.614 0

GKlambdayx 0.22581 0.028383 7.9556 1.7764e-15

tauyx 0.091674 0.013524 6.7788 1.2121e-11

Hyx 0.08716 0.011265 7.7374 1.0214e-14

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ ________ ________

CramerV 0.3326 0.024431 0.28471 0.37287

GKlambdayx 0.22581 0.028383 0.17018 0.28144

tauyx 0.091674 0.013524 0.065168 0.11818

Hyx 0.08716 0.011265 0.065082 0.10924

Example of option conflev.

Example of option conflev.

Example of option conflev.

Example of option conflev.Use data from Goodman Kruskal (1954).

N=[1768 807 189 47

946 1387 746 53

115 438 288 16];

out=corrNominal(N,'conflev',0.99);

Chi2 index

1.0735e+03

pvalue Chi2 index

1.1244e-228

Phi index

0.3973

Cramer's V

0.2810

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ _________ ______ ____

CramerV 0.28095 0.0088396 31.784 0

GKlambdayx 0.19239 0.012158 15.825 0

tauyx 0.080883 0.0046282 17.476 0

Hyx 0.075341 0.0041619 18.102 0

-----------------------------------------

Indexes and 99% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ ________ ________

CramerV 0.28095 0.0088396 0.25818 0.30241

GKlambdayx 0.19239 0.012158 0.16108 0.22371

tauyx 0.080883 0.0046282 0.068962 0.092805

Hyx 0.075341 0.0041619 0.064621 0.086061

Related Examples

corrNominal with option dispresults.

N=[ 6 14 17 9;

30 32 17 3];

out=corrNominal(N,'dispresults',false);

Example which starts from the original data matrix.

N=[26 26 23 18 9;

6 7 9 14 23];

% From the contingency table reconstruct the original data matrix.

n11=N(1,1); n12=N(1,2); n13=N(1,3); n14=N(1,4); n15=N(1,5);

n21=N(2,1); n22=N(2,2); n23=N(2,3); n24=N(2,4); n25=N(2,5);

x11=[1*ones(n11,1) 1*ones(n11,1)];

x12=[1*ones(n12,1) 2*ones(n12,1)];

x13=[1*ones(n13,1) 3*ones(n13,1)];

x14=[1*ones(n14,1) 4*ones(n14,1)];

x15=[1*ones(n15,1) 5*ones(n15,1)];

x21=[2*ones(n21,1) 1*ones(n21,1)];

x22=[2*ones(n22,1) 2*ones(n22,1)];

x23=[2*ones(n23,1) 3*ones(n23,1)];

x24=[2*ones(n24,1) 4*ones(n24,1)];

x25=[2*ones(n25,1) 5*ones(n25,1)];

% X original data matrix (in this case an array)

X=[x11; x12; x13; x14; x15; x21; x22; x23; x24; x25];

out=corrNominal(X,'datamatrix',true);

Example of option datamatrix combined with X defined as table.

Initial contingency matrix (2D array).

N=[75 126

76 203

40 129

36 125

24 110

41 222

19 141];

% Labels of the contingency matrix

Party={'ACTIVIST DEMOCRATIC', 'DEMOCRATIC', ...

'SIMPATIZING DEMOCRATIC', 'INDEPENDENT', ...

'LIKING REPUBLICAN', 'REPUBLICAN', ...

'ACTIVIST REPUBLICAN'};

DeathPenalty={'AGAINST' 'FAVORABLE'};

Ntable=array2table(N,'RowNames',Party,'VariableNames',DeathPenalty);

% From the contingency table reconstruct the original data matrix now

% using FSDA function

% The output is a cell arrary

Xcell=crosstab2datamatrix(Ntable);

Xtable=cell2table(Xcell);

% call function corrNominal using first argument as input data matrix

% in table format and option datamatrix set to true

out=corrNominal(Xtable,'datamatrix',true);

Example: compare confidence interval for Cramer V.

Example: compare confidence interval for Cramer V.

Example: compare confidence interval for Cramer V.

Example: compare confidence interval for Cramer V.Use the 4 possible methods

method={'ncchisq', 'ncchisqadj', 'fisher' 'fisheradj'};

% Use a contingency table referred to type of job vs wine delivery

rownam={'Butcher' 'Carpenter' 'Carter' 'Farmer' 'Hunter' 'Miller' 'Taylor'};

colnam={'Wine not delivered' 'Wine delivered'};

N=[85 9

214 56

212 19

100 17

139 15

109 16

172 29];

Ntable=array2table(N,'RowNames',rownam,'VariableNames',colnam);

ConfintV=zeros(4,2);

for i=1:4

out=corrNominal(Ntable,'conflimMethodCramerV',method{i});

ConfintV(i,:)=out.ConfLimtable{'CramerV',3:4};

end

disp(array2table(ConfintV,'RowNames',method,'VariableNames',{'Lower' 'Upper'}))

Chi2 index

21.0290

pvalue Chi2 index

0.0018

Phi index

0.1328

Cramer's V

0.1328

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ _________ ______ _________

CramerV 0.13282 0.04149 3.2013 0.0013679

GKlambdayx 0 0 NaN NaN

tauyx 0.017642 0.0078826 2.2381 0.025218

Hyx 0.021875 0.0095422 2.2924 0.021883

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ _________ ________

CramerV 0.13282 0.04149 0.051504 0.17582

GKlambdayx 0 0 0 0

tauyx 0.017642 0.0078826 0.0021921 0.033091

Hyx 0.021875 0.0095422 0.0031721 0.040577

Chi2 index

21.0290

pvalue Chi2 index

0.0018

Phi index

0.1328

Cramer's V

0.1328

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ _________ ______ __________

CramerV 0.13282 0.023037 5.7657 8.1331e-09

GKlambdayx 0 0 NaN NaN

tauyx 0.017642 0.0078826 2.2381 0.025218

Hyx 0.021875 0.0095422 2.2924 0.021883

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ _________ ________

CramerV 0.13282 0.023037 0.087671 0.18959

GKlambdayx 0 0 0 0

tauyx 0.017642 0.0078826 0.0021921 0.033091

Hyx 0.021875 0.0095422 0.0031721 0.040577

Chi2 index

21.0290

pvalue Chi2 index

0.0018

Phi index

0.1328

Cramer's V

0.1328

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ _________ ______ _________

CramerV 0.13282 0.028675 4.632 3.621e-06

GKlambdayx 0 0 NaN NaN

tauyx 0.017642 0.0078826 2.2381 0.025218

Hyx 0.021875 0.0095422 2.2924 0.021883

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ _________ ________

CramerV 0.13282 0.028675 0.076621 0.18818

GKlambdayx 0 0 0 0

tauyx 0.017642 0.0078826 0.0021921 0.033091

Hyx 0.021875 0.0095422 0.0031721 0.040577

Chi2 index

21.0290

pvalue Chi2 index

0.0018

Phi index

0.1328

Cramer's V

0.1328

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ _________ ______ __________

CramerV 0.13282 0.028646 4.6366 3.5418e-06

GKlambdayx 0 0 NaN NaN

tauyx 0.017642 0.0078826 2.2381 0.025218

Hyx 0.021875 0.0095422 2.2924 0.021883

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ _________ ________

CramerV 0.13282 0.028646 0.076676 0.18824

GKlambdayx 0 0 0 0

tauyx 0.017642 0.0078826 0.0021921 0.033091

Hyx 0.021875 0.0095422 0.0031721 0.040577

Lower Upper

________ _______

ncchisq 0.051504 0.17582

ncchisqadj 0.087671 0.18959

fisher 0.076621 0.18818

fisheradj 0.076676 0.18824

CorrNominal when input is 2 by 2.

CorrNominal when input is 2 by 2.

CorrNominal when input is 2 by 2.

CorrNominal when input is 2 by 2.Indexes theta=cross product ratio, Q and U are also computed.

% X=advertisment memory (rows)

% Y=product purchase (columns)

N= [87 188;

42 406];

nam=["Yes" "No"];

Ntable=array2table(N,"RowNames",nam,"VariableNames",nam);

disp('Input 2x2 contingency table')

table(Ntable,RowNames=["X=advertisment memory" "advertisment memory "],VariableNames="Y=Product purchase")

out=corrNominal(Ntable)

Input 2x2 contingency table

ans =

2×1 table

Y=Product purchase

__________________

Yes No

___ ___

X=advertisment memory Yes 87 188

advertisment memory No 42 406

Chi2 index

57.6071

pvalue Chi2 index

3.2006e-14

Phi index

0.2823

Cramer's V

0.2823

-------------------------------

2x2 contingency table indexes

th=cross product ratio

4.4734

Cross product ratio in the interval [-1 1]. Index Q=(th-1)/(th+1)

0.6346

Cross product ratio in the interval [-1 1]. Index U=(sqrt(th)-1)/(sqrt(th)+1)

0.3580

-------------------------------

Test of H_0: independence between rows and columns

Coeff se zscore pval

________ ________ ______ __________

CramerV 0.28227 0.037189 7.5902 3.1974e-14

GKlambdayx 0 0 NaN NaN

tauyx 0.079678 0.020787 3.8331 0.00012653

Hyx 0.082782 0.021327 3.8816 0.00010376

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

________ _____________ ________ ________

CramerV 0.28227 0.037189 0.20938 0.35516

GKlambdayx 0 0 0 0

tauyx 0.079678 0.020787 0.038937 0.12042

Hyx 0.082782 0.021327 0.040983 0.12458

out =

struct with fields:

N: [2×2 double]

Ntable: [2×2 table]

Chi2: 57.6071

Chi2pval: 3.2006e-14

Phi: 0.2823

CramerV: [0.2823 0.0372 7.5902 3.1974e-14]

GKlambdayx: [0 0 NaN NaN]

tauyx: [0.0797 0.0208 3.8331 1.2653e-04]

Hyx: [0.0828 0.0213 3.8816 1.0376e-04]

ConfLim: [4×4 double]

ConfLimtable: [4×4 table]

TestInd: [4×4 double]

TestIndtable: [4×4 table]

theta: 4.4734

Q: 0.6346

U: 0.3580

Contrib2Chi2: [2×2 double]

Contrib2Chi2table: [2×2 table]

Contrib2Hyx: [2×2 double]

Contrib2Hyxtable: [2×2 table]

Contrib2tauyx: [2×2 double]

Contrib2tauyxtable: [2×2 table]

Example of call to CorrNominal with optional input argument plots.

Example of call to CorrNominal with optional input argument plots.

Example of call to CorrNominal with optional input argument plots.

Example of call to CorrNominal with optional input argument plots.Load the Housetasks data (a contingency table containing the frequency of execution of 13 house tasks in the couple).

N=[156 14 2 4;

124 20 5 4;

77 11 7 13;

82 36 15 7;

53 11 1 57;

32 24 4 53;

33 23 9 55;

12 46 23 15;

10 51 75 3;

13 13 21 66;

8 1 53 77;

0 3 160 2;

0 1 6 153];

rowslab={'Laundry' 'Main-meal' 'Dinner' 'Breakfast' 'Tidying' 'Dishes' ...

'Shopping' 'Official' 'Driving' 'Finances' 'Insurance'...

'Repairs' 'Holidays'};

colslab={'Wife' 'Alternating' 'Husband' 'Jointly'};

Ntable=array2table(N,'VariableNames',colslab,'RowNames',rowslab);

% Call to corrNominal with option 'plots',true

corrNominal(Ntable,'plots',true);

Chi2 index

1.9445e+03

pvalue Chi2 index

0

Phi index

1.0559

Cramer's V

0.6096

Test of H_0: independence between rows and columns

Coeff se zscore pval

_______ ________ ______ ____

CramerV 0.60963 0.016701 36.502 0

GKlambdayx 0.50787 0.018427 27.561 0

tauyx 0.40671 0.013787 29.5 0

Hyx 0.40833 0.013767 29.659 0

-----------------------------------------

Indexes and 95% confidence limits

Value StandardError ConflimL ConflimU

_______ _____________ ________ ________

CramerV 0.60963 0.016701 0.57689 0.63133

GKlambdayx 0.50787 0.018427 0.47175 0.54398

tauyx 0.40671 0.013787 0.37969 0.43374

Hyx 0.40833 0.013767 0.38134 0.43531

Input Arguments

N — Contingency table (default) or n-by-2 input dataset.

Matrix or Table.

Matrix or table which contains the input contingency table (say of size I-by-J) or the original data matrix.

In this last case N=crosstab(N(:,1),N(:,2)). As default procedure assumes that the input is a contingency table.

If N is a data matrix (supplied as a a n-by-2 cell array of strings, or n-by-2 array or n-by-2 table) optional input datamatrix must be set to true.

Data Types: single| double

Name-Value Pair Arguments

Specify optional comma-separated pairs of Name,Value arguments.

Name is the argument name and Value

is the corresponding value. Name must appear

inside single quotes (' ').

You can specify several name and value pair arguments in any order as

Name1,Value1,...,NameN,ValueN.

'conflev',0.99

, 'conflimMethodCramerV','fisheradj'

, 'dispresults',false

, 'Lr',{'a' 'b' 'c'}

, 'Lc',{'c1' c2' 'c3' 'c4'}

, 'datamatrix',true

, 'NoStandardErrors',true

, 'plots',true

conflev

—Confidence levels to be used to

compute confidence intervals.scalar.

The default value of conflev is 0.95, that is 95 per cent confidence intervals are computed for all the indexes (note that this option is ignored if NoStandardErrors=true).

Example: 'conflev',0.99

Data Types: double

conflimMethodCramerV

—method to compute confidence interval for CramerV.character.

Character which identifies the method to use to compute the confidence interval for Cramer index. Default value is 'ncchisq'. Possible values are 'ncchisq', 'ncchisqadj', 'fisher' or 'fisheradj'; 'ncchisq' uses the non central chi2. 'ncchisq' uses the non central chi2 adjusted for the degrees of fredom. 'fisher' uses the Fisher z-transformation and 'fisheradj' uses the fisher z-transformation and bias correction.

Example: 'conflimMethodCramerV','fisheradj'

Data Types: character

dispresults

—Display results on the screen.boolean.

If dispresults is true (default) it is possible to see on the screen all the summary results of the analysis.

Example: 'dispresults',false

Data Types: Boolean

Lr

—Vector of row labels.cell.

Cell containing the labels of the rows of the input contingency matrix N. This option is unnecessary if N is a table, because in this case Lr=N.Properties.RowNames;

Example: 'Lr',{'a' 'b' 'c'}

Data Types: cell array of strings

Lc

—Vector of column labels.cell.

Cell containing the labels of the columns of the input contingency matrix N. This option is unnecessary if N is a table, because in this case Lc=N.Properties.VariableNames;

Example: 'Lc',{'c1' c2' 'c3' 'c4'}

Data Types: cell array of strings

datamatrix

—Data matrix or contingency table.boolean.

If datamatrix is true the first input argument N is forced to be interpreted as a data matrix, else if the input argument is false N is treated as a contingency table. The default value of datamatrix is false, that is the procedure automatically considers N as a contingency table. In case datamatrix is true N can be a cell of size n-by-2 containing the two grouping variables or a numeric array of size n-by-2 or a table of size n-by-2.

Example: 'datamatrix',true

Data Types: logical

NoStandardErrors

—Just indexes without standard errors and p-values.boolean.

if NoStandardErrors is true just the indexes are computed without standard errors and p-values. That is no inferential measure is given. The default value of NoStandardErrors is false.

Example: 'NoStandardErrors',true

Data Types: Boolean

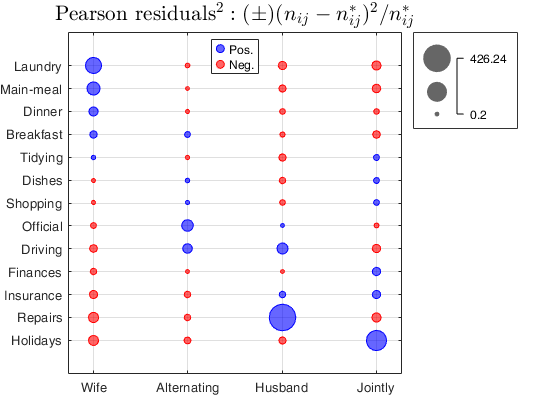

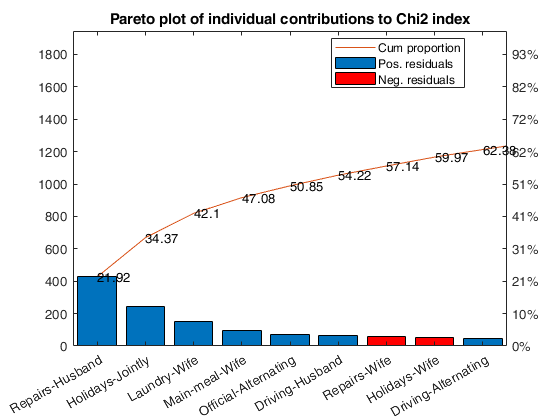

plots

—balloonplot of squared Pearson residuals and Pareto plot

of squared Pearson residuals.boolean.

If plots is true the following two plots of Pearson squared residuals are shown on the screen.

1) a bubble plot (ballonplot);

2) a Pareto plot.

In both plots entries of the contingency table associated with positive association (positive residuals) are shown in blue while those associated with negative association (negative residuals) are shown in red.

The default value of plots is false.

Example: 'plots',true

Data Types: Boolean

Output Arguments

out — description

Structure

Structure which contains the following fields:

| Value | Description |

|---|---|

N |

I-by-J-array containing contingency table referred to active rows (i.e. referred to the rows which participated to the fit). The (i,j)-th element is equal to n_{ij}, i=1, 2, \ldots, I and j=1, 2, \ldots, J. The sum of the elements of out.N is n (the grand total). |

Ntable |

same as out.N but in table format (with row and column names). This output is present just if your MATLAB version is not<2013b. |

Chi2 |

scalar containing \chi^2 index. |

Chi2pval |

scalar containing pvalue of the \chi^2 index. |

Phi |

\Phi index. Phi is a chi-square-based measure of association that involves dividing the chi-square statistic by the sample size and taking the square root of the result. More precisely \Phi= \sqrt{ \frac{\chi^2}{n} } This index lies in the interval [0 , \sqrt{\min[(I-1),(J-1)]}. |

CramerV |

1 x 4 vector which contains Cramer's V index, standard error, z test, and p-value. Cramer'V index is index \Phi divided by its maximum. More precisely V= \sqrt{\frac{\Phi}{\min[(I-1),(J-1)]}}=\sqrt{\frac{\chi^2}{n \min[(I-1),(J-1)]}} The range of Cramer index is [0, 1]. A Cramer's V in the range of [0, 0.3] is considered as weak, [0.3,0.7] as medium and > 0.7 as strong. The way in which the confidence interval for this index is specified in input option conflimMethodCramerV. If conflimMethodCramerV is 'ncchisq', 'ncchisqadj' we first find a confidence interval for the non centrality parameter \Delta of the \chi^2 distribution with df=(I-1)(J-1) degrees of freedom. (see Smithson (2003); pp. 39-41) [\Delta_L \Delta_U]. If input option conflimMethodCramerV is 'ncchisq', confidence interval for \Delta is transformed into one for V by the following transformation V_L=\sqrt{\frac{\Delta_L }{n \min[(I-1),(J-1)]}} and V_U=\sqrt{\frac{\Delta_U }{n \min[(I-1),(J-1)]}} If input option conflimMethodCramerV is 'ncchisqadj', confidence interval for \Delta is transformed into one for V by the following transformation V_L=\sqrt{\frac{\Delta_L+ df }{n \min[(I-1),(J-1)]}} and V_U=\sqrt{\frac{\Delta_U+ df }{n \min[(I-1),(J-1)]}} |

GKlambdayx |

1 x 4 vector which contains index \lambda_{y|x} of Goodman and Kruskal standard error, z test, and p-value. \lambda_{y|x} = \sum_{i=1}^I \frac{r_i- r}{n-r} r_i =\max(n_{ij}) r =\max(n_{.j}) |

tauyx |

1 x 4 vector which contains tau index \tau_{y|x}, standard error, ztest and p-value. \tau_{y|x}= \frac{\sum_{i=1}^I \sum_{j=1}^J f_{ij}^2/f_{i.} -\sum_{j=1}^J f_{.j}^2 }{1-\sum_{j=1}^J f_{.j}^2 } |

Hyx |

1 x 4 vector which contains the uncertainty coefficient index (proposed by Theil) H_{y|x}, standard error, ztest and p-value. H_{y|x}= \frac{\sum_{i=1}^I \sum_{j=1}^J f_{ij} \log( f_{ij}/ (f_{i.}f_{.j}))}{\sum_{j=1}^J f_{.j} \log f_{.j} } |

TestInd |

4-by-4 array containing index values (first column), standard errors (second column), zscores (third column), p-values (fourth column). |

TestIndtable |

4-by-4 table containing index values (first column), standard errors (second column), zscores (third column), p-values (fourth column). |

ConfLim |

4-by-4 array containing index values (first column), standard errors (second column), lower confidence limit (third column), upper confidence limit (fourth column). |

ConfLimtable |

4-by-4 table containing index values (first column), standard errors (second column), lower confidence limit (third column), upper confidence limit (fourth column). |

theta |

cross product ratio. This index is computed just if the input table is 2-by-2 |

Q |

cross product ratio in the interval [-1 1] using the Q rescaling Q=(th-1)/(th+1). This index is computed just if the input table is 2-by-2 |

U |

cross product ratio in the interval [-1 1] using the U rescaling U=(sqrt(th)-1)/(sqrt(th)+1). This index is computed just if the input table is 2-by-2 |

Contrib2Chi2 |

I x J array containing the contributions (with sign) to the Chi2 index. Note that sum(abs(out.Contrib2chi),'all')=out.Chi2. |

Contrib2Chi2table |

same of out.Contrib2chi but in table format |

Contrib2Hyx |

I x J array containing the contributions to the Hyx index. Note that sum(out.Contrib2Hyx,'all')=out.Hyx. |

Contrib2Hyxtable |

same of out.Contrib2Hyx but in table format |

Contrib2tauyx |

I x J array containing the contributions to the tauyx index. Note that sum(out.Contrib2tauyx,'all')=out.tauyx. |

Contrib2tauyxtable |

same of out.Contrib2tauyx but in table format |

More About

Additional Details

In the contingency table N of size I \times J, whose i,j entry is n_{ij}, the Pearson residuals are defined as \frac{n_{ij}-n_{ij}^*}{\sqrt{n_{ij}^*}} where n_{ij}^* is the theoretical frequency under the independence hypothesis. The sum of the squares of the Pearson residuals is equal to the \chi^2 statistic to test the independence between rows and columns of the contingency table.

\lambda_{y|x} is a measure of association that reflects the proportional reduction in error when values of the independent variable (variable in the rows of the contingency table) are used to predict values of the dependent variable (variable in the columns of the contingency table). The range of \lambda_{y|x} is [0, 1]. A value of 1 means that the independent variable perfectly predicts the dependent variable. On the other hand, a value of 0 means that the independent variable does not help in predicting the dependent variable.

More generally, let V(y) a measure of variation for the marginal distribution (f_{.1}=n_{.1}/n, ..., f_{.J}=n_{.J}/n) of the response y and let V(y|i) denote the same measure computed for the conditional distribution (f_{1|i}=n_{1|i}/n, ..., f_{J|i}=n_{J|i}/n) of y at the i-th setting of the explanatory variable x. A proportional reduction in variation measure has the form.

\frac{V(y) - E[V(y|x)]}{V(y|x)} where E[V(y|x)] is the expectation of the conditional variation taken with respect to the distribution of x. When x is a categorical variable having marginal distribution, (f_{1.}, \ldots, f_{I.}), E[V(y|x)]= \sum_{i=1}^I (n_{i.}/n) V(y|i) = \sum_{i=1}^I f_{i.} V(y|i) If we take as measure of variation V(y) the Gini coefficient V(y)=1 -\sum_{j=1}^J f_{.j} \qquad V(y|i)=1 -\sum_{j=1}^J f_{j|i}

we obtain the index of proportional reduction in variation \tau_{y|x} of Goodman and Kruskal.

\tau_{y|x}= \frac{\sum_{i=1}^I \sum_{j=1}^J f_{ij}^2/f_{i.} -\sum_{j=1}^J f_{.j}^2 }{1-\sum_{j=1}^J f_{.j}^2 } If, on the other hand, we take as measure of variation V(y) the entropy index V(y)=-\sum_{j=1}^J f_{.j} \log f_{.j} \qquad V(y|i) -\sum_{j=1}^J f_{j|i} \log f_{j|i}

we obtain the index H_{y|x}, (uncertainty coefficient of Theil).

H_{y|x}= \frac{\sum_{i=1}^I \sum_{j=1}^J f_{ij} \log( f_{ij}/ (f_{i.}f_{.j}))}{\sum_{j=1}^J f_{.j} \log f_{.j} }

The range of \tau_{y|x} and H_{y|x} is [0 1].

A large value of of the index represents a strong association, in the sense that we can guess y much better when we know x than when we do not.

In other words, \tau_{y|x}=H_{y|x} =1 is equivalent to no conditional variation in the sense that for each i, n_{j|i}=1. For example, a value of: \tau_{y|x}=0.85 indicates that knowledge of x reduces error in predicting values of y by 85 per cent (when the variation measure which is used is the Gini's index).

H_{y|x}=0.85 indicates that knowledge of x reduces error in predicting values of y by 85 per cent (when variation measure which is used is the entropy index) Remark: if the contingency table is of size 2x2 the following indexes are also computed theta=cross product ratio, index Q

Q= \frac{\theta-1}{\theta+1} and U U= \frac{\sqrt{\theta}-1}{\sqrt{\theta}+1}References

Agresti, A. (2002), "Categorical Data Analysis", John Wiley & Sons. [pp.

23-26]

Goodman, L.A. and Kruskal, W.H. (1959), Measures of association for cross classifications II: Further Discussion and References, "Journal of the American Statistical Association", Vol. 54, pp. 123-163.

Goodman, L.A. and Kruskal, W.H. (1963), Measures of association for cross classifications III: Approximate Sampling Theory, "Journal of the American Statistical Association", Vol. 58, pp. 310-364.

Goodman, L.A. and Kruskal, W.H. (1972), Measures of association for cross classifications IV: Simplification of Asymptotic Variances, "Journal of the American Statistical Association", Vol. 67, pp. 415-421.

Liebetrau, A.M. (1983), "Measures of Association", Sage University Papers Series on Quantitative Applications in the Social Sciences, 07-004, Newbury Park, CA: Sage. [pp. 49-56]

Smithson, M.J. (2003), "Confidence Intervals", Quantitative Applications in the Social Sciences Series, No. 140. Thousand Oaks, CA: Sage. [pp.

39-41]

Acknowledgements

See Also

crosstab

|

rcontFS

|

CressieRead

|

corr

|

corrOrdinal