We assume that the vectors x contains discrete observations from a diffusion

process $x$ following the Ito stochastic differential equation

$$dx(t)= \sigma(t) \ dW(t) + b(t) \ dt,$$

$$d\sigma^2(t)= \gamma(t) \ dZ(t) + a(t) \ dt,$$

where $W$ and $Z$ are two Brownian motions defined on the filtered probability space

$(\Omega, (\mathcal{F}_t)_{t \in [0,T]}, P)$, with correlation $\rho$, while

$\sigma, \gamma, b$ and $a$ are random processes, adapted to $\mathcal{F}_t$.

See the References for further mathematical details.

The spot volatility of volatility at time $t \in [0,T]$ is defined as

$$C(t):=\frac{d\langle \sigma^2,\sigma^2 \rangle_t}{dt}=\gamma^2(t).$$

For any positive integer $n$, let $\mathcal{S}_{n}:=\{ 0=t_{0}\leq \cdots

\leq t_{n}=T \}$ be the observation times. Moreover, let $\delta_l(x):=

x(t_{l+1})-x(t_l)$ be the increments of $x$.

The Fourier estimator of the spot volatility of volatility at time $t \in [0,T]$ is

given by

$$\widehat C_{n,N,M,L}(\tau)= \sum_{|k|\leq L} \left(1-{|k|\over

L}\right)c_k(C_{n,N,M}) \, e^{{\rm i}\frac{2\pi}{T}k\tau},$$

where:

$$c_k(C_{n,N,M})= {T \over {2M+1}} \sum_{|s|\leq M} c_s(d\sigma_{{n},N})c_{k-s}(d\sigma_{{n},N}),$$

$$c_k(d\sigma_{{n},N})={\rm i} \, k\, \frac{2\pi}{T}

c_k(\sigma_{{n},N}), \quad c_k(\sigma_{n,N})={T\over {2N+1}} \sum_{|s|\leq N} c_{s}(dx_{n})c_{k-s}(dx_{n}),$$

$$c_k(dx_{n})= {1\over {T}} \sum_{l=0}^{n-1} e^{-{\rm i}\frac{2\pi}{T}kt_l}\delta_{l}(x).$$

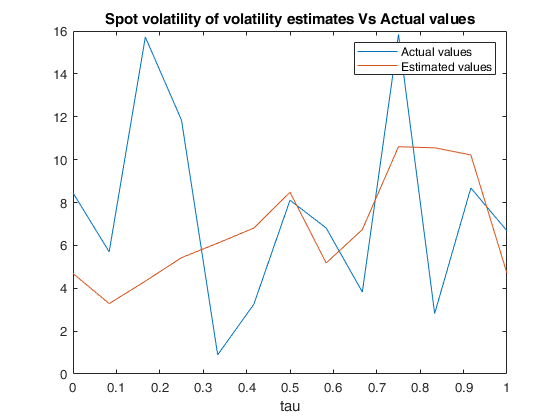

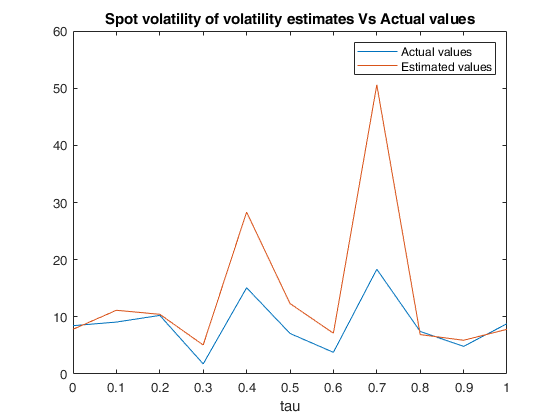

Example of call of FM_spot_volvol with default values of N,M,L and tau.

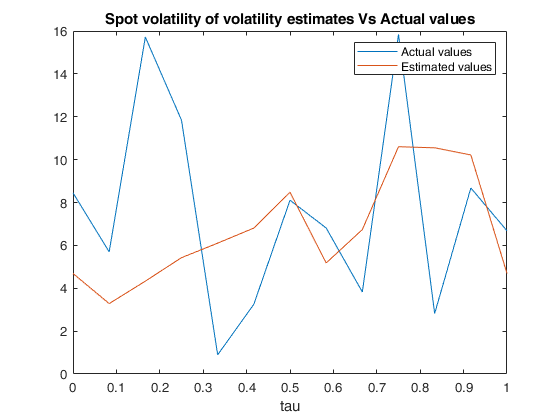

Example of call of FM_spot_volvol with default values of N,M,L and tau.